Alright, folks. Back to real life. Sorry about the hiatus, but I'm finally unpacked and I'm feeling pretty settled in :) This post is a doozy but I think it's one of the most important things that people wanted to know about, so I took a page from Tolkien (lol) and erred on the side of including too much rather than too little. I know it's a bit long, but see below for a map of the path we'll be taking and a summary on the Most Important Points of the post. If you're strapped for time and need to read in chunks, the outline and summary should help remind you where you left off. Enjoy!

Outline and Summary (aka tl;dr)

Introduction

Step 1: Figure out how much you have to spend.

Step 2: Figure out how much you need to survive and how much you need to live

comfortably but not excessively.

Step 3: Trim the fat.

Step 4: You won't miss what you never had.

Step 5: Plan for emergencies.

Step 6: Consider carefully what is a "want" vs a "need" before permitting yourself to spend outside of your budget.

Step 7: Give yourself some wiggle room.

Step 8: Bonuses don't exist. Tax returns also don't exist. Red envelopes are actually a figment of your imagination. (Also Social Security, for you long-term planners). These are all magical fairy rainbows that are not dependable and could disappear in a puff of smoke at any second.

Step 9: Don't forget the big picture. Also, don't worry about everyone else. Just worry about you and getting yourself to a good place. No need to compare dick sizes because let's be honest. No one ever wins that game.

Conclusion

Summary: Storing the Acorns

This section is highlighted to signal to the reader that it is important.

If there is one thing you remember about this post, I want it to be this: always live beneath your means. It would be stupid for a squirrel to collect all the acorns and then eat them that very same day. The squirrel works hard to collect enough acorns for dinner and also for a snowy day in the future. We may be less attractive (or less aggressive, if we're guys) than the squirrels, but we sure as hell aren't going to let them be smarter than us, are we?!

One of the fastest ways to fail at this whole "live beneath your means" thing is to upsize your lifestyle too quickly. It's so much easier to upsize than it is to downsize, so start small and stay small. When you start earning a paycheck for the first time or you get a raise, I suggest not instantly upgrading your lifestyle. Continue living the way you have, and put that extra cash towards achieving your financial goals. There's going to be a lot of cliche truisms coming up, but here's one to get us started: you won't miss what you never had. You wouldn't give a little kid a lollipop and then snatch it away, would you? That's just cruel. Don't do it to yourself either.

don't do this to yourself.

If you're already living at or above your means, you need to trim the fat from your budget. Get out the trimmers. A good rule of thumb I like to follow when setting my budget for everyday expenses is to budget in such a way that I am living comfortably, but a $100/month reduction in my budget would definitely squeeze me.

This rule is so important because it allows you to maintain your standard of living when you retire, if you get laid off, if you or your partner decide to stay home and raise the kids, etc. It's not easy to do, but it forms a really solid foundation for financial stability. We'll touch on some of these concepts again in greater detail, but if you're short on time, read this highlighted section and internalize it. If you can live beneath your means, you have won more than half the battle.

I'll get off my soap box. Let's get started.

el oh el

Introduction

Budgeting is one of the most important life skills you can develop. It's right up there with learning how to make ramen. In fact, if you budget properly, I'd argue that you won't even need to learn how to make ramen.

Though...if you can make this and you live in Brooklyn,

I'd also argue that you might not even need to learn how to budget...

Bonus points if you can throw in a cronut.

Whether you're living off an allowance from your parents, earnings from a part-time job, or holding down a full-time job and trying your damned best to be a real adult, you will need to budget. Everyone has limited resources and even if you have infinite parent-backed pockets, it's still a good idea to learn how to budget in case you decide you want to be 100% financially independent.

Fortunately, budgeting is a pretty simple concept. All you need to remember is:

Spend less than you make. Also known as:

Live beneath your means. Also known as:

Save more acorns than you need.

It sounds so easy right? Then why are so many people bad at budgeting? Why do a lot of us resort to living paycheck to paycheck or fall back on our credit cards? Obviously this whole budgeting thing is not as easy as it looks.

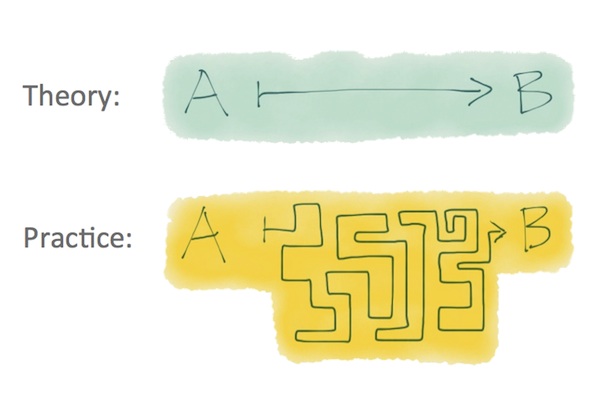

"In theory, there is no difference between

theory and practice. In practice, there is."

- Yogi Berra or Manfred Eisen (google is ambivalent, so I credited both)

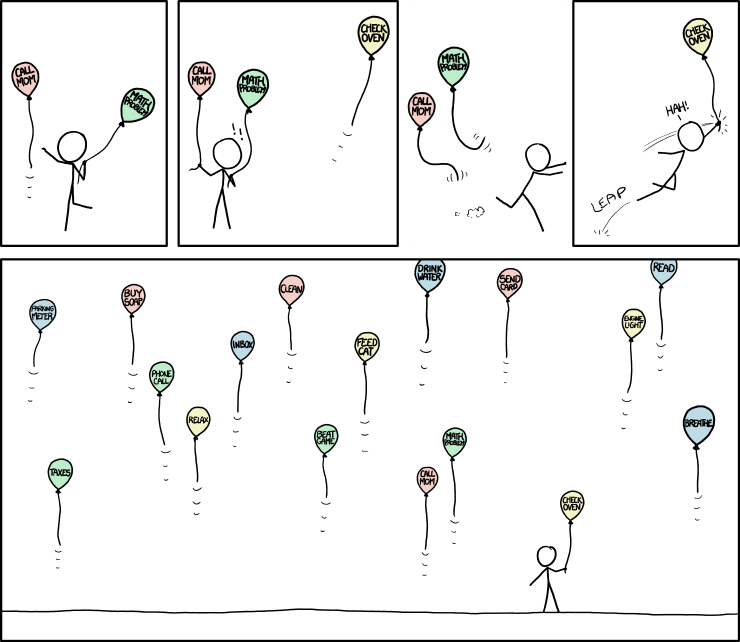

All sorts of things get in the way of budgeting successfully. Emergencies happen. We see something we really want and we have to have it

NOW. Peer pressure. It's too much effort and we're busy focused on studying or working. We're juggling a lot of things and budgeting just slips by the wayside.

my life on a regular basis.

probably yours too.

budgeting doesn't even get a mention here, probably because "breathe" is more important.

I do see taxes though!

The easiest way to budget is to make it the default setting for our lives. This concept is also known as

"setting yourself up for success." As a lazy person, I like this very much. I don't have a lot of willpower, so if I don't set myself up for success, I usually fail. Sad but true. I assume that if you have a lot of awesome willpower, you already budget well and don't need to read this post.

The rest of us: read on and let's set ourselves up for success! Not all of these suggestions will work for you, but it is my hope that a few points will be new and useful to you in your quest towards financial security.

I like to budget on a monthly and yearly basis out of convenience, as most paychecks, bills, and expenses can be measured in those time increments. Please feel free to adjust to a daily, weekly, or quarterly schedule, if that works better for you.

I also use excel <3 to track my expenses, but use any writing or tracking tool you like. Just make sure to write it down somehow, even if it's on a sheet of paper, and use it consistently and regularly. Make it a habit, like brushing your teeth.

sorry not sorry

Step 1: Figure out how much you have to spend.

This is important. Before you start calculating and projecting and doing all sorts of crazy shenanigans, you need to know what you have to work with.

- For those of us who take home a paycheck, this is pretty straightforward. Look at how much you receive each month after taking out taxes, insurance, and other deductibles.

- If you're a student, this might be your loan check, your summer earnings, your college savings, or an allowance from your parents.

Step 2: Figure out how much you need to survive and how much you need to live comfortably but not excessively.

I'm talking basic needs here. This includes:

- shelter (rent)

- food (groceries, doesn't include eating out)

- water (doesn't include alcohol, should be free...?)

- Since we're modern, civilized human beans living in the good ol' USA, we will also include other "needs" like utilities (electricity/cable)

- phone

- dry cleaning/laundry

- transportation (bus/train fare, gas, car insurance, parking, cabs)

- soap

Once you have your bare bones budget, you can build in categories for what I consider discretionary spending (if you have room). These are things you don't

need, but that make your life 100x better for having them in your life. This includes stuff like alcohol (yes, it has it's own category in my budget), eating out with friends, fun things (e.g. movies, concerts), late night cabs, clothes, household needs (e.g. laundry detergent, lightbulbs), and anything else you find yourself spending money on regularly. This will vary from person to person, as all of us value things differently.

I find it best to track my spending for a month or two and see how much I'm actually spending in each category. It then becomes easier to create a realistic budget for myself.

WARNING:

If your budget exceeds how much you have to spend, you have exactly two options: spend less or earn more.

When I started building out my budget, I was a full time employee with ridiculous hours and a clause built in my contract that stated that I could not work for anyone else, so I found it easier to just spend less money. I'd say 9 times out of 10, it's easier to just spend less. However, if you're a student and you're already living on a shoestring budget, it might be easier to earn more by taking a part-time job, tutoring, or babysitting on the weekends. Consider carefully which option makes more sense for you and go with that. If you decide to spend less...

This is emergency triage budgeting. I recommend you take a hard look at your life, cut all discretionary spending and adopt an extra roommate. Why? Rent has anecdotally been the biggest expense category for students and recent grads and is the likely culprit for your hemorrhaging budget. For those who are working full time, I would recommend spending no more than 20% of your pre-tax paycheck on rent. If you take home $5,000 per month, that means you should pay no more than $1,000 in rent. If you are paying off student loans or credit card debt, I recommend spending even less than that on rent. Except for SF and NY, this should be relatively achievable.

Step 3: Trim the fat.

Track your spending for a month or two. Try tracking every expenditure (credit cards make this fantabulously easy). You'll open your eyes to where your money is really going and you'll find a lot of places where a simple change could save you a lot of money every month.

For example, if you drink Starbucks lattes every morning, that adds up super fast. Try swapping out a latte for plain black drip coffee with a bit of milk and sugar. It's probably healthier for you too. Cook lunch at home instead of buying lunch every day at work.

If you notice yourself spending more money on alcohol than on rent, you should probably reconsider whether that's really necessary in your life. Although I personally haven't done that yet (partly because NY rent was so high that it would have been quite difficult as a girl to spend that much on booze), I definitely had a few friends who probably did that. Choosing to skip out on even one weekend of clubbing every month and a random Vegas trip would have saved them about $10,000 every year by my estimation. They wouldn't even miss out all that much, since they were too blackout drunk to remember what happened anyways. But I digress.

Catch these low hanging fruits, where you are spending money on things that you don't think are really worth it, and you'll see your budget start perking up and looking healthier right away. Once you cut out these unnecessary expenses, it's time to set these numbers in stone. This is your budget now and it's your job to live within these parameters to the best of your ability.

snip snip. sometimes even I don't know how I find these things

Step 4: You won't miss what you never had.

But how do I resist the temptation to spend the extra cash I'm saving from all my hard work? Remember what we said about setting ourselves up for success? The easiest way to keep yourself from spending that extra money you're saving is to put it away before you can even touch it. It's just like tucking away the cookies on the top shelf of the pantry in a box, tied with string.

Cookies in a box

Source: everyone should know this <3

For students, you can set up a separate bank account where you put the extra cash you're saving up. Don't touch this cash. Don't even think about it. It doesn't exist. Put an invisibility cloak on it and give the Marauder's Map to someone else.

For those of us who are working, we can also set up a separate bank account (I have three), but we should make sure to take advantage of any pre-tax deductions available to us. That means making automatic monthly contributions to your 401k account and putting money into your FSA if you need one. You should also be setting aside automatic contributions to your emergency savings account each month. This leads us to step 5.

Step 5: Plan for emergencies.

Life isn't perfect, and there will be occasions you won't be able to plan for where you will need some extra cash to tide you over. Sometimes these are bad things, such as getting laid off, getting your phone stolen (or losing it every year, like me), having your car break down, needing to attend a funeral, or getting injured. Sometimes this extra cash will give you the flexibility to do things like put down a security deposit on an apartment or making a tax-advantaged decision (more on this later).

It's important to have a cushion that we can rely on if something unexpected happens because the only thing we know for sure about unexpected events is that they

will happen at some point. We should get in the habit of creating an emergency fund now, because this will only become more important as we get older and as other people start depending on us to support them.

Make sure you "spend" a set amount each month on your emergency fund. Treat it like your rent or electricity bill. This is not negotiable. How much should this amount be? A good rule of thumb is to save 10% of your gross salary until you save up enough to cover six months of your (and your family's) basic expenses. The only exception to this rule is if you have credit card debt. That should be paid down first before you build an emergency fund.

SOS!!! Emergencies happen!

ok, this is a stretch. but I needed an excuse to include this in here because if any of you see a dress like this that I can pull off (aka has adequate support), I would love to know. I'm 100% sure that it doesn't exist though. :'[

Step 6: Consider carefully what constitutes a "want" vs a "need" before permitting yourself to spend outside of your budget.

Once you set a budget, it's important to stick to it. It's easy to get caught up in believing that you really need a lot of stuff and using that belief to justify a purchase. Snap out of it. You may

want stuff, but you don't

need it. If it's a need, it's probably an emergency (e.g. my car broke down) and I should expand my budget to accommodate that need. If it's a want (e.g. I lost my earmuffs on the Blue line T_T), then I should reduce my spending in other areas to accommodate that want. For example, if I want another pair of earmuffs because my ears will freeze and that makes me upset, I may choose to give up 4 beers for the month of November and buy a pair of earmuffs instead. Or not.

If you really find yourself pinched every month, consider adjusting your budget. Although you'll need to make difficult decisions and make some sacrifices to stay within budget, you shouldn't be punishing yourself excessively if you don't have to. A good rule of thumb is to budget enough to be comfortable, but close enough to the edge that a 10% reduction in your budget would make everyday life really difficult. Be realistic with yourself so you don't give up just because you can't meet your monthly goals.

You're not trying to deprive yourself; you're making lifestyle changes to help you achieve your long term goals.

*Side note: I totally justify clothing purchases by thinking about cost per wear. This is a nifty trick where you think about how often you'll wear something and divide the purchase price by that and see if that's something you'd be willing to pay. For example, pretend I see a pair of earmuffs that cost $40. I will wear my earmuffs every day for the winter and part of spring and fall. That's at least 200 days of wear. Assuming I manage to not lose them for one year, which is possible, though difficult, this translates into 20 cents per day. I would pay more than 20 cents per day to keep my ears warm, making these earmuffs a wonderful investment!

Time for a break!

Get up and wander around. Then pretend you're watching LOTR and come right back. :)

Step 7: Give yourself some wiggle room.

Remember how we talked about setting ourselves up for success? That means giving ourselves some room to play. Most of the time, we will need to make decisions between competing wants and buy something we want by giving up something else. This is good for building discipline and this is what budgeting is ultimately all about.

However, it's no fun to stress over money making decisions ALL the time. Sometimes little things pop up that we want to spend our hard earned cash on and not have to think too hard about. It's easy to resent your budget unless you give yourself some wiggle room.

Every month, we budget for our emergency fund. I find it personally helpful to also budget for a "gifts and fun things" fund. I save away a chunk of cash every month that I dip into whenever I want to go on vacation, buy presents, make charitable donations, treat myself or my friends out to unexpected dinners, or spoil myself at Sephora. If you are including bigger ticket items that you can plan for, like vacations or shopping sprees, make sure to plan a budget for these things and then overestimate how much you'll spend. This allows us some breathing room to spend without guilt while we're enjoying ourselves and keeps us from stressing over pennies (and still stay on track!)

oh yeah. livin it up, betches.

Step 8: Bonuses don't exist. Tax returns also don't exist. Red envelopes are actually a figment of your imagination. (Also Social Security, for you long-term planners). These are all magical fairy rainbows that are not dependable and could disappear in a puff of smoke at any second.

These cash inflows are not predictable, and you can screw yourself pretty badly if you count on them to save you. Better to assume they don't exist and get pleasantly surprised when they land in your checking account, than to rack up credit card debt and pray you get paid a big enough bonus to pay it all off. I know a few banker friends who did the latter and they were constantly stressed out. One of them wanted to quit their job but couldn't, because they were counting on that bonus. Don't be that guy.

Think of the vanishing magic rabbits so often found peering dazedly out of a magician's black silk top hat.

This is that rabbit. You have been warned.

With respect to taxes - although most employers are good about withholding more than you need from your paycheck, you might find that your return is smaller than you expected. You might fall victim to identity theft and someone could steal your tax return. You might find out you suddenly owe surprise back taxes on something. This is why it's doubly important to have an emergency cash cushion!

While we're on the topic...

WARNING ABOUT CREDIT CARDS:

Credit cards are awesome for building up credit, but. Say you have $15 in your bank account. You go out to brunch with your friends and you get some pancakes, coffee, and a mimosa or six. You obviously don't have enough cash on hand, so you just charge your brunch to your credit card and tell yourself, "Oh, I'll pay it off when I get my next paycheck." Should be fine right? WRONG. This is a tricky habit to fall into, and once you start slip-sliding down that rabbit hole, guess what? There's a snake waiting at the bottom of that hole and you, my dear little rabbit, aren't going to see the happy sunlight of day ever again.

Ugh. I was going to insert a picture of a snake in action here,

but I googled "snake bite" and the images were

so gruesome, I closed that tab in like two seconds.

You'll have to find your own scary snake pictures.

Credit card debt is painful, punishing, and could potentially ding your credit score. Don't fuck with that shit.

Treat your credit card like a debit card. If you can't control your credit card spending, don't feel ashamed! We all have our vices and weaknesses (mine comes in the form of ice cream). Instead, take your card(s) and a large pair of scissors, cut them up, and throw the pieces away.

Tip: If you're following our main concepts (living below your means and building in buffers), you should be able to automatically reduce the chance that you'll spend more than you actually have. Isn't it nice how everything ties in together? It's like magic.

It has teeth O_O

Eat it before it eats you!

Step 9: Don't forget the big picture. Also, don't worry about everyone else. Just worry about you and getting yourself to a good place. No need to compare dick sizes because let's be honest. No one ever wins that game.

At the end of the day, money isn't everything. It's just a tool. Live your life in the present, not just in the future. (See? I told you, lots of cliches).

Has anyone else seen this incredibly adorable Kacey Musgraves Oreo ad?

No? Here it is, you can thank me later:

Short, sweet, makes me hit replay 10985235 times.

This is how ads should be made. Always.

Make sure you are spending your money on the things that bring you the most enjoyment in your life.

Also...My dad, who is the frugal one in the family, once explained to me that we shouldn't save money for the sake of having it. Rather, we save so that when the time comes, we are able to spend it gracefully on the things that really matter. That lesson really stuck with me. While everyone will have different spending habits and patterns, I still think it's important to keep in mind what the ultimate purpose of money really should be. Whether it's a wonderful event like a wedding or an emergency, you don't want a lack of financial power to cloud your joy or make an already difficult situation even worse. Having said that, don't focus so much on saving money that you no longer enjoy your day to day life.

Money is freedom; it should not be a ball and chain! Balance accordingly, my friends.

Another ad!

Conclusion

Phew. Everyone still with me? I hope this was a clear and accessible guideline of how to approach setting up a budget. Since everyone's circumstances are so different, I didn't want to delve too deeply into specific examples, though I might build out a follow up post later, if you guys think that would be helpful. Don't forget to reassess periodically if your budget still makes sense for you. Adjust as necessary!

Please, if you have questions or need help building out charts in excel, ask away. Financial literacy and independence, especially for young women like us, is something I really believe in. If anyone has additional budgeting tips and tricks, sharing is caring!!! As I've said before, I'm hardly an expert and I'd love to learn more from you girls.

Best of all, don't forget that you're probably already a budgeting expert! Whether it's time or your alcohol intake on a Friday night, you've already probably exercised your budgeting skills. Given limited stuff (minutes, drinks, dollars), decide the best way to consume that stuff to achieve your goals. That's it! See? You already have this skill set! So go forth, save and allocate your resources, and tell winter to suck it. ^_^

|

One last picture for kicks and giggles. (I take full responsibility for the terribleness).

Note: having nuts, even frozen ones > having no balls.

so save yo nuts.

Source: some runner dude's blog |